Japan Polyethylene Wax Market Statistics, Growth, Price, Trends

According to a research report published by Spherical Insights & Consulting, " Japan Polyethylene Wax Market Size " is expected to reach USD 5,742 million by 2035 with a CAGR growth of 8.8% from 2025 to 2035. The Japanese polyethylene wax market is expanding due to increased demand for construction, printing and plastics. Important drivers are its use in the production of PVC (a lubricant and mold release agent) and printing inks, which are driven by technological advances, government support for innovation, and sustainability concerns.

Market Overview

The Japanese polyethylene wax market refers to synthetic waxes produced from polyethylene resins, which are mostly used as additives to improve processing, hardness, and surface properties of plastics, paints, inks, adhesives, and cosmetics. Waxes improve glide, abrasion and dispersion and are therefore essential for applications in the packaging, automotive, printing and personal care industries. Stimulating the market are the increasing demand for high grade materials, increased packaging production, increased automotive production and the need for durable coatings and additives. Japan's strong chemical manufacturing base and superior R&D capabilities support product quality and innovation. In line with international environmental trends, opportunities are being realized through increased use of sustainable packaging and green formulations. Government policies to support environmental sustainability and strengthen controls on chemical safety have led manufacturers to create biodegradable and low volatile polyethylene waxes.

Report Coverage

This research report categorizes the Japan polyethylene wax market on the basis of different sectors and regions, forecasts revenue growth and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities and challenges affecting the Japan polyethylene wax market. Recent market developments and competitive strategies such as expansions, product launches as well as developments, partnerships, mergers and acquisitions are included to map the competitive landscape of the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan polyethylene wax market.

Driving Factors

The demand for better processing and surface characteristics in plastics, coatings, inks, adhesives, cosmetics, and other products has driven the growth of Japan's polyethylene wax market. Increased packaging production and enhanced automotive manufacturing have boosted demand for long-lasting, high-performance additives. With advancements in research and development, product quality and innovation have improved. Additionally, the growing consumer demand for green and sustainable products has driven the formulation of biodegradable waxes. Government-promoted environmental legislation, by inducing safer and more environmentally friendly polyethylene wax options, further drives market growth.

Constraints

The Japanese polyethylene wax market is constrained by fluctuating raw material prices, stringent environmental laws, and high manufacturing costs. Additionally, competition from other waxes and additives, as well as the challenges of creating fully biodegradable products, also inhibit market growth and adoption.

Market Segmentation

The Japanese polyethylene wax market is segmented by product, technology, and application.

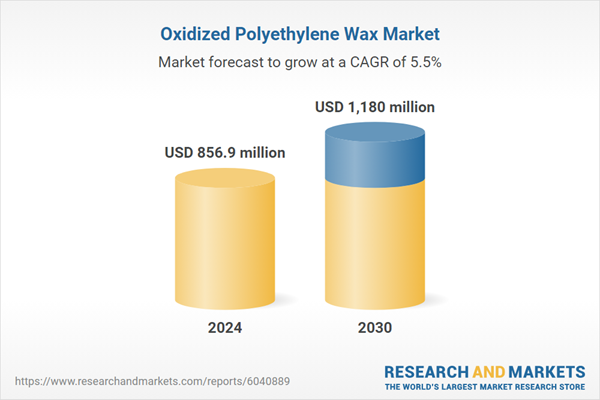

Oxidized PE wax sheets accounted for the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period.

The Japanese polyethylene wax market is segmented by product into low-density polymer PE wax, high-density polymer PE wax, micro-peaked PE wax, oxidized PE wax, etc. Among these, oxidized PE wax sheets accounted for a significant share in 2024 and are expected to grow at a significant CAGR during the forecast period. This is due to its superior compatibility with polar resins and its fine dispersion. Its widespread use is driven by the significant demand in coatings, polyvinyl chloride (PVC) composites, and water-based emulsions, particularly in the packaging, textile, and adhesive industries. Continuous technological advancements in formulation and application further facilitate this demand.

The polymerization segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Japanese polyethylene wax market is technologically segmented into polymerization, thermal cracking, micronization, modification, etc. Among these, the polymerization segment held the largest market share in 2024 and is expected to grow at a CAGR during the forecast period. This is because it can produce high-purity wax with uniform molecular weight and performance. This process is widely used in the production of PE wax and polyvinyl chloride processing for precision applications such as coatings and inks, providing better quality, stability, and compatibility for various industrial applications.

The candle segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese polyethylene wax market is segmented by application into forestry and fire-resistant wood, packaging, plastic additives, lubricants, candles, cosmetics, printing inks, rubber, and others. Among these, the candle segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing demand for long-lasting, smoke-free, and clean-burning candles. PE wax enhances candle hardness, has a high fragrance retention rate, and provides a smooth finish. Its low cost and stability make it a viable option for both functional and decorative candle production.

Competitive Analysis:

The report provides an appropriate analysis of the key organizations/companies participating in the Japanese polyethylene wax market, with a comparative evaluation primarily based on their product offerings, business profiles, regional presence, corporate strategies, market share, and SWOT analysis. The report also offers a detailed analysis highlighting current news and developments within the companies, including product development, innovation, joint ventures, partnerships, mergers and acquisitions, and strategic alliances. This enables an evaluation of the overall competitive landscape within the market.

Key Companies List

Mitsui Chemicals Co., Ltd.

Kuraray Co., Ltd.

Sanyo Chemical Industries, Ltd.

BASF Japan

Asahi Kasei Corporation

Meiji Japan

Lubrizol Corporation

INEOS Group Limited.

Anonymous Securities Co., Ltd.

Trekola Resources

Dear

Wisla Chemical Co., Ltd.

Others

Recent Developments:

In November 2024, BASF launched “Easiplas,” a new high-density polyethylene (HDPE) brand, achieving a key construction milestone at its “Zhejiang Verbund” plant. The Easiplas name combines “ease of use,” “ethylene,” and “plastics,” highlighting BASF's full integration into the C2 value chain and commitment to market demand.

Key Target Audience

Market Players

Investors

End Users

Government Authorities

Consulting and Research Companies

Venture Capitalists

Value-Added Distributors

Market Segments

This study forecasts revenue trends for Japan, regional, and national levels from 2020 to 2035. The spherical perspective has segmented the Japanese polyethylene wax market based on the following segments: 1.

Japanese Polyethylene Wax Market by Product

Low-Density Polymer PE Wax

High-density polymer PE wax

Micro PE wax

Oxidized PE wax

Others

Japanese Polyethylene Wax Market by Technology

Diversification

Thermal cracking

Micro-sizing

Modification

Others

Japanese Polyethylene Wax Market by Application

Forestry and fire prevention logs

Packaging

Plastic additives

Lubricants

Candles

Cosmetics

Printing ink

Rubber

Others